According to Companies House, over 190,000 companies have started up in the UK during lockdown.

They’re in good company with Disney, Microsoft, HP, IBM, and Electronic Arts, all starting during a recession.

Their growth and size are the exception to the rule however, with companies who start during a recession, tending to start on a smaller scale, and remain smaller throughout their life.

The harsh reality is that 20% of new businesses never celebrate their first birthday. 60% will not be around in three years.

Let’s put the negativity aspect to one side. You’re excited. It’s a new idea. It’s a fantastic idea!

This article is to help your intentions turn into a bright future. After all, this could soon become your biggest investment, if it’s not already.

Business Planning

An entrepreneur friend said to me a few years ago, “The more I plan, the more successful the idea tends to be”. It’s no wonder with it so crowded out there.

Preparation helps you both short and long term. When it comes to your new business, relevance with people you sell to and having a plan in place is going to be your best allies.

In terms of quickly understanding your starting position, resources at your disposal, who you should target and who to avoid, I would say look no further than a SWOT Analysis.

You’re probably aware that SWOT represents your Strengths, Weaknesses, Opportunities, and Threats.

The Strengths and Weaknesses are Internal (potentially just you) and in the Present. This becomes your current starting position, as it is a reflection of today.

The Opportunities and Threats are External (so potential customers, suppliers, and competition) and this relates to the future.

A solid SWOT analysis should outline the task ahead (in bullet point form) and hopefully which Opportunities you should focus your Service on, which Strengths you should promote, which Weaknesses you may need to rectify, and which Threats you need to steer clear of. It provides a strong barometer of where you are today and the challenges and possibilities that lie ahead.

Let’s Identify the Typical Reason’s Why Companies Fail

It’s money, isn’t it?

This is where thoughtful business planning and considered forecasting will help steer your ship.

If you plan well, and map your forecasted route, you will know when you are falling behind key targets before it’s over, affording you enough time to adjust your attention and resources to make up the shortfall.

I am sure I say this in every article I share with you, but Forecasting (or Budgeting) has to start with Sales. Getting this wrong is the difference between your success and failure.

Essentially, if you can’t estimate what Sales – from a cash received perspective – your business is intending to make, you can’t possibly budget the investments and other expenditures you’re preparing to make.

However, if you are just starting, this just might be the only time when you need to calculate something else first. That is, what is the minimum amount of money you need personally, to survive.

If we know your business will have to cease trading – and you go back to full-time employment – if your business isn’t pulling in enough profit to pay for your life, then we need to start by looking at:

1. How much salary do you need each month?

2. How much savings do you currently have?

Knowing both of these numbers provides you with your personal run-way. Run-Way is a business term that refers to the time (typically in months) remaining before you run out of cash.

Burn-Rate, is the amount of cash you need, or plan on spending, every month.

For small, one-man-band startups, it is worth calculating your burn-rate and run-way on both a personal and business perspective to understand the task ahead.

This is your biggest risk.

Objectives

If you list a set of objectives for your first year and achieve them, you would be very unlucky if your business fails. Or more likely, you have hit upon the wrong objectives!

You have hopefully already established your first objective. That is, what sales you need to make and by when to continue trading.

If I were you, I would map these sales out in a spreadsheet across the next 12 or 24 months.

Break them down. What sales targets do you need to hit and by when?

Now, think about the ways you can achieve them.

What are Your Other Objectives for the Year?

I would recommend you look back at your SWOT analysis to understand what needs to be in place, and in what priority order. This now provides you with a list of objectives.

Where an objective comes with a cost, such as your website design, then you need to add that cost to your Budget and assign it to the target completion month/s.

Other objectives can be harder to achieve. As an example, think about what it takes to gain 1,000 social media followers. You break the target down. When do you want to achieve 1,000 followers? If in 12 months, then you probably need 300 by month 6 and then 600 by month nine.

Breaking objectives down enables you to refocus efforts when you fall behind the target.

Pricing

Pricing is the question I am most frequently asked about.

How do I recommend you price your service or product?

The answer has to be, whatever price will keep you in business in 6 months and then 12 months time.

This may mean reducing your price – or incentivising customers – to establish those early sales, gain references, establish your presence, and to gain confidence in your marketplace. You may therefore need to include activity such as discounts on your business plan and sales targets.

One thing to remember, the more you invest in advertising and marketing, providing you get it right, the higher your perceived value might be.

Let’s Start Wrapping Up

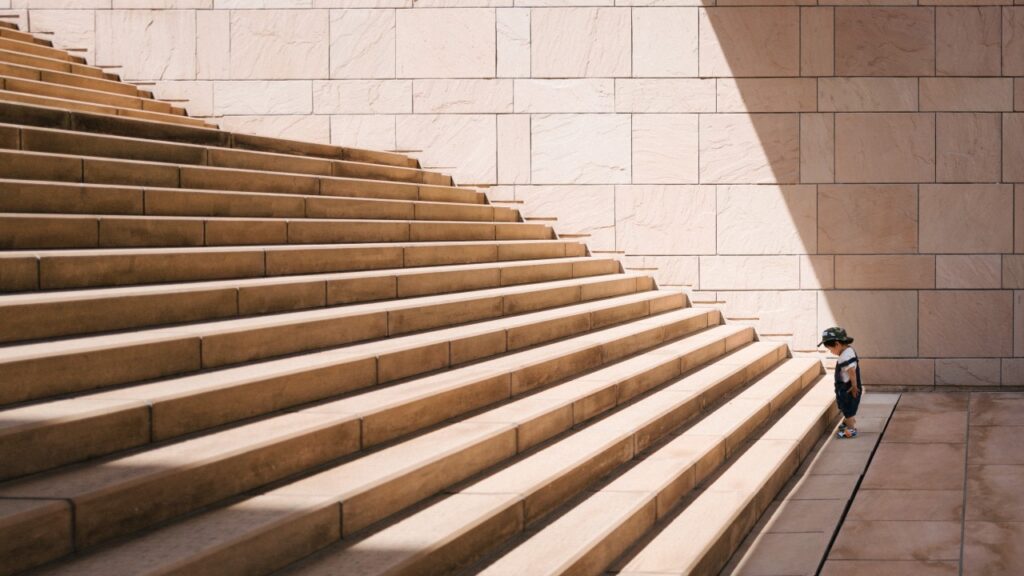

On a personal note, I want to recognise that everyone starts from a different position.

Some people are known names in their industry. Some people start with immediate clients from their previous job. Others – like me – will have arrived from a back-office function, with no connections or leads.

All of these starting positions represent a bright future. All of them come with Strengths and Weaknesses, albeit with a very different first few years.

If you are starting out with little, I promise you from experience that providing you listen and learn and adapt that you will very quickly gain a competitive advantage in the market.

In my experience, small owner-managed businesses don’t ‘go bust’. So let’s attempt to remove that worry.

Going bust or bankrupt suggests you have racked up thousands of pounds in debt or signed personal guarantees. This is unusual – unless you have gone big.

In most cases, businesses fail in the first year because they have not been able to scale quickly enough to pay for the owner’s life commitments such as the mortgage, rent and just living. In fact, according to private equity firm, CB Insights, the biggest reason companies fail, is not down to being a part of a very competitive world, it’s because there was no market need for a product. What you sell, has to be something where there is a market need.

Let’s Bring to a Close

Let’s be honest, everyone gets excited by a new idea. It paints a picture of hope, optimism and new opportunity.

Planning that new business can be fun too, but don’t get lost on logo designs, font types and telling everyone to follow your company page on LinkedIn (unless that is a key objective).

If you follow my very brief advice above, you would be pretty unlucky if your new venture doesn’t fly. Let me know how you get on. You can reach out to me here christophergrubb@informperform.co.uk

=

The right Virtual Finance Director is as committed to your business as a full-timer, but without the overhead.

I’m Chris, and I help business leaders clarify, simplify and improve the financial performance of their business. Maybe I can help you too?